Trading

NATURAL GAS SUPPLY OF WESTERN SWITZERLAND

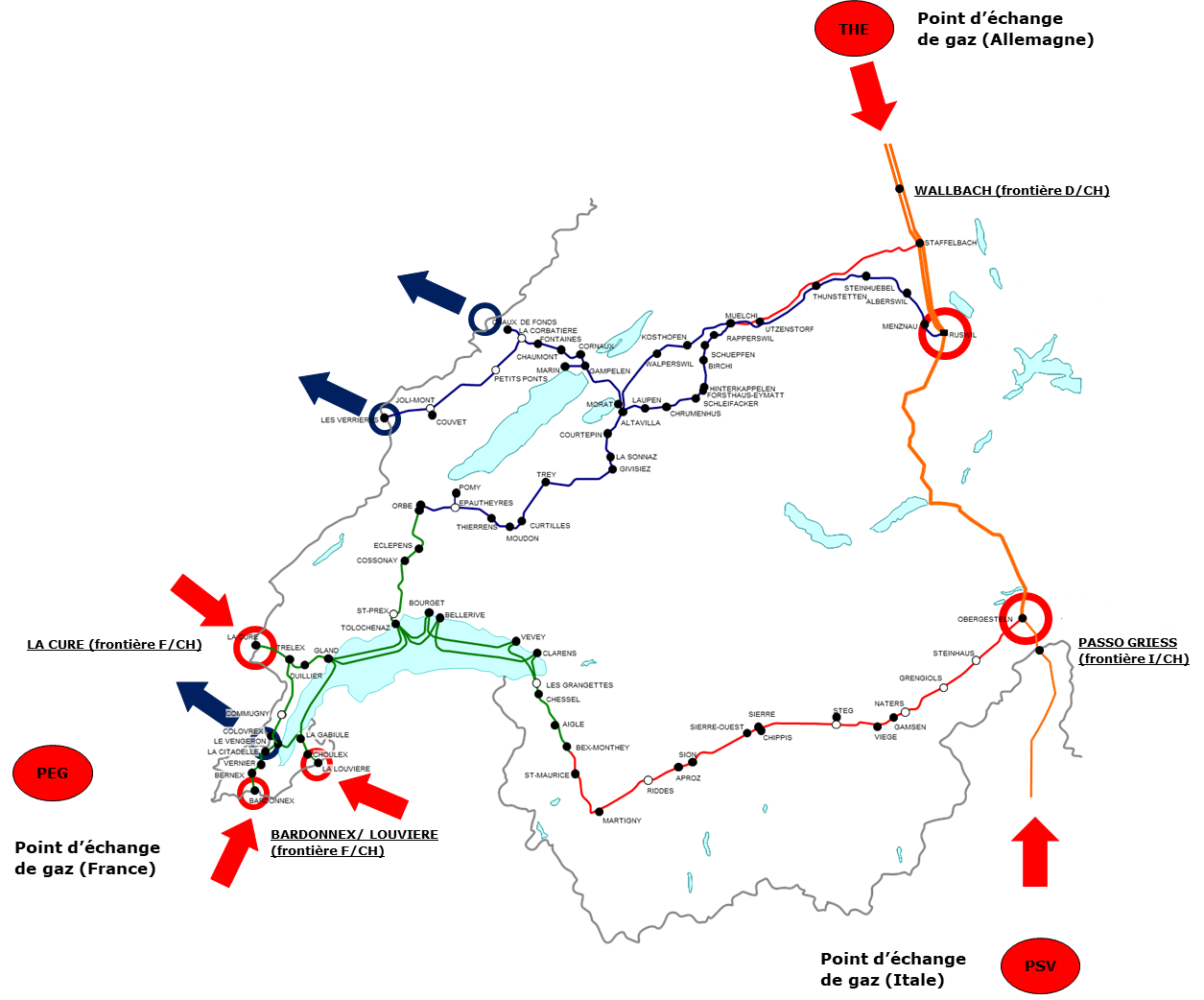

Gaznat Trading supplies an area which benefits from a unique location in Europe where clients can be supplied from:

— Germany (« THE » hub). The natural gas is in this case transported from Wallbach at the German-Swiss border to Ruswil where it is re-compressed (if the pressure situation in the Swiss networks requires it) and then transported via the Swiss Plateau to the major consumption centers in western Switzerland around the Arc Lémanique region (referring to the crescent-shaped region around Lake Geneva);

— France (« PEG » hub). The gas is imported to La Cure (in the Jura near Saint-Cergue), Bardonnex and La Louvière (Geneva). It arrives directly in the Gaznat zone;

— Italy (« PSV » hub). The gas is imported at Passo Griess and enters the Gaznat zone a few kilometers further into the Upper Valais.

This situation guarantees a wide range of supply sources and thus a high level of supply security. Since natural gas was first introduced to Switzerland in the 1970s, there has been no disruption in gas deliveries. Moreover, Gaznat Trading exploits the possibility of switching the supply between the three countries mentioned above depending on the prices (arbitrage) and, more rarely, on the possible supply restrictions caused by maintenance or technical interruptions on the natural gas pipelines.

Gaznat Trading buys gas at gas exchange points (hubs) in countries bordering Switzerland. However, some gas is purchased from the TTF (Netherlands) and transported to Wallbach. The origin of gas sold at exchange points can be certified at an additional cost. For most of Gaznat's imports, the origin of the gas is not certified. Based on statistics provided by network operators, it is estimated that 28% of the natural gas consumed in Western Europe in 2023 will come from Norway, 11% from North Africa and Azerbaijan, and 7% from Russia. In addition, 16% of the gas consumed in Europe was produced in Europe in 2023. This share includes locally produced biomethane. Since the summer of 2022 and the reduction in Russian pipeline exports, a significant proportion (38% in 2023) of gas consumed in Europe has been liquefied gas delivered by LNG tanker. In 2023, 47% of this gas will come from the United States, 13% from Qatar, 12% from Russia, 10% from Algeria and 5% from Nigeria.

Read more about European supply.

NATURAL GAS PURCHASES ON INTERNATIONAL MARKETS

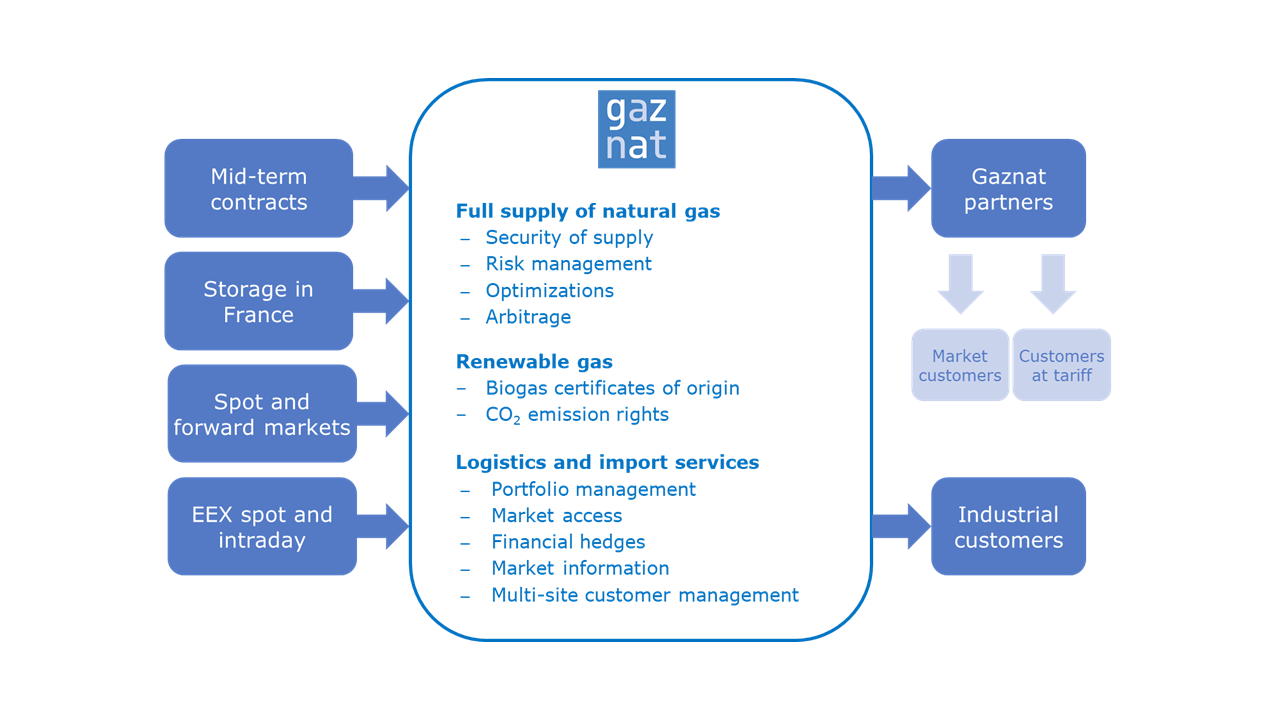

Supply security, natural gas supply at the best price and the development of high value-added services are the basic mission of the Trading department. Two types of contracts are used to secure supply:

— Medium- and long-term contracts (2 to 10 years);

— Short-term contracts (spot for the next day and forward for up to 2 years).

MEDIUM- AND LONG-TERM CONTRACTS

Medium- and long-term contracts (today a time span of 2 to 10 years, historically a time span of 20 to 30 years) ensure the delivery of sufficient quantities of natural gas over the long term to meet customers' needs. They involve purchases of natural gas from different geographical sources. Their diversification makes it possible to reduce the risks linked with possible disruptions and also to curtail overall costs by using differences in price behavior.

Gaznat currently has medium-term supply contracts for delivery to the northern border of Switzerland and from the West to the French border. A balanced supply between North and West is important for pressure balancing issues in the networks. Besides, Gaznat has also concluded a storage contract in France, allowing to manage fluctuations in demand, especially during periods of severe cold. The storage is filled during the summer when demand and prices are low. Gaznat in this way benefits from cheap gas during the winter season when demand and prices are high.

SHORT-TERM CONTRACTS

Gaznat short-term trading has developed gradually since 2007. When market conditions are favorable, Gaznat completes its supply structure with spot purchases. This makes it possible to arbitrate between medium-term contracts and spot markets. Upon concluding several European Federation of Energy Traders (EFET) framework contracts with recognized European counterparties, Gaznat concludes mainly purchase transactions at the TTF (Netherlands), THE (Germany), PEG (France) and PSV (Italy) virtual trading points. Spot market liquidity has improved considerably over the past few years on Switzerland's border trading points. Short-term trading has become a reliable and competitive way to optimize portfolios and capture market opportunities. In addition, Gaznat offers its customers access to forward markets, enabling them to price gas for supply in flat volumes up to three years in advance. Natural gas pipeline capacities to Wallbach (gas entry point in Switzerland from northern Europe) as well as to La Cure and Bardonnex / La Louvière (gas entry points in western Switzerland from France) have to be secured in addition.

75% or so of the gas volumes purchased in 2023 were acquired through transactions on the spot and forward markets.

PRICE COMPONENTS

For end users, the price of gas breaks down into the cost of the gas molecule, its transport (high-pressure transport, then distribution), a possible contribution to storage, its marketing and taxes.

Natural gas is a network energy; as such, a large share of the costs is linked to the means of transport used between the production plants and the consumption centers (natural gas pipelines or LNG carriers/tank ships). As this transport is carried out over long distances, it must be continuous in order to optimize costs.

For the price of the gas molecule itself, Gaznat's supply contracts are today all indexed to the prices of the German, French and Dutch gas markets. These prices depend on supply and demand. Today, this mechanism works well in Europe because the markets are sufficiently "liquid", i.e. there is enough gas and a sufficient number of buyers and sellers for an equilibrium price to be established. The world reference market remains the Henry Hub, which is located in Louisiana. In Europe, the main markets are located in the Netherlands (TTF - Title Transfer Facility), the United Kingdom (NBP - National Balancing Point), Germany (THE - Trading Hub Europe), France (PEG - Point d'Echange de Gaz), Italy (PSV - Punto di Scambio Virtuale) and Austria (CEGH - Central European Gas Hub).

When natural gas markets in Europe did not yet exist or were not liquid enough and therefore prices were not sufficiently unanimous, the gas price purchased through long-term contracts was linked to that of oil products. This historical practice was also explained by the fact that, at the time of the first negotiated contracts, both the producer and the consumer wanted to obtain a cost in relation to that of the majority competing energy on the market, namely heating oil. Today, a growing proportion of long-term contracts have been renegotiated and are indexed to market prices on the hubs (THE, TTF).

Also read: Market Price Report • 2023

GAZNAT SALES

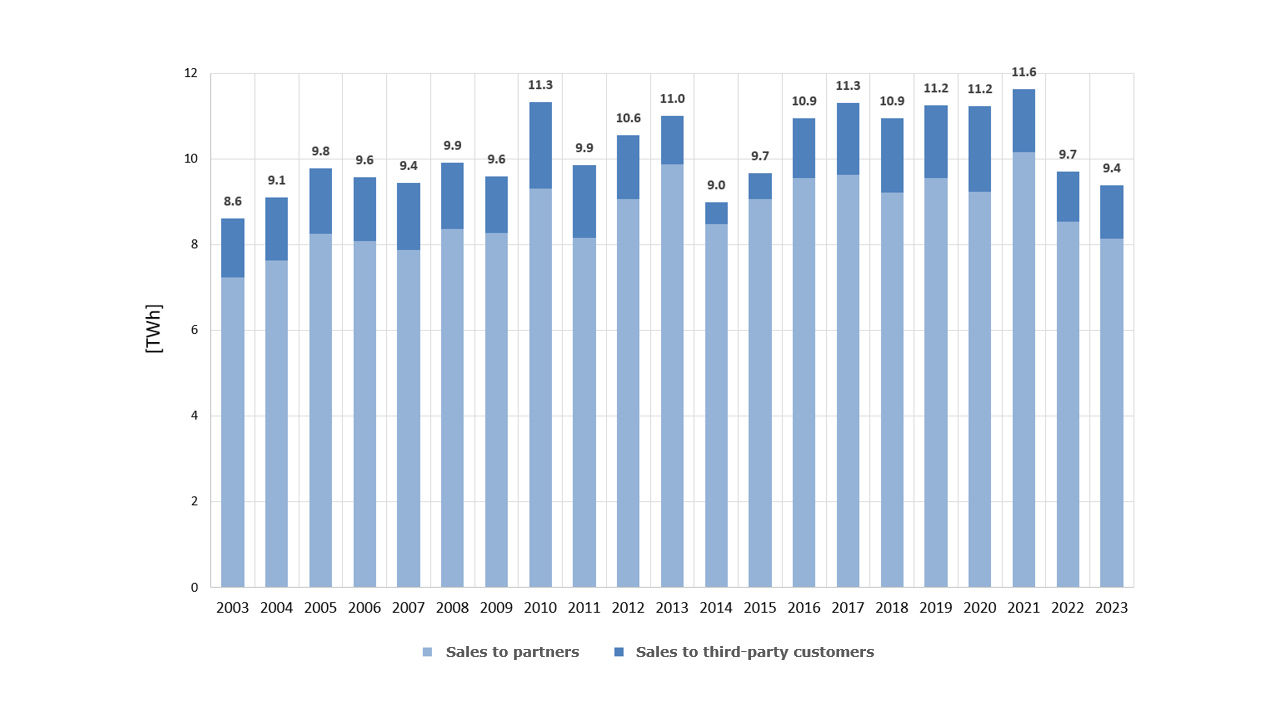

85% of Gaznat Trading supplies go to Gaznat shareholders. The balance is sold directly to large industrial customers with direct access to Gaznat's high-pressure pipeline networks.

Gaznat sales reached 9,378 GWh in 2023, a drop of almost 20% since 2021, explained not only by high winter temperatures but also by the use of other sources of heat, notably renewable, and changes in behavior. This is the effect of the energy transition and high prices during the gas crisis that followed the almost complete interruption of Russian gas deliveries by pipeline.