Supply

RESERVES

As at end 2020, overall world's proven natural gas reserves were estimated at 188,000 billion cubic meters or "bcm", which represents more than 50 years of consumption at the current pace. 40% of these reserves are located in the Middle East, 30% in Russia and Turkmenistan, 8% in North America (mainly in the United States), 7% in Africa (mainly in Algeria and Nigeria) and only 1.7% in Europe (mainly in Norway, Ukraine, the Netherlands and the United Kingdom). The remainder is divided between South America and the Asia-Pacific region.

New gas fields are found on a regular basis, transforming so-called "probable" reserves into "proved" reserves. As a result, the estimated deadline for the depletion of this resource is constantly being extended. Since natural gas is fossil, it will however have to be gradually replaced by renewable gases (biogas, synthetic methane or hydrogen) to reduce greenhouse gas emissions.

(Source: BP Statistical review 2021 and 2022)

PRODUCTION

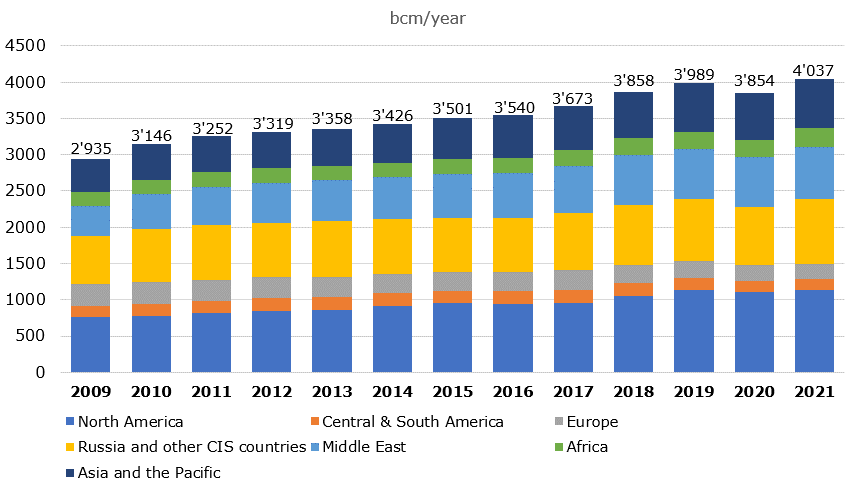

Global gas production amounted to 4'037 bcm in 2021, up 2.2%/year since 2011. The world's largest gas producers are the United States (934 bcm in 2021), followed by Russia (702 bcm), Iran (257 bcm), China (209 bcm) and Qatar (177 bcm). In Europe, Norway produced 114 bcm in 2021, the United Kingdom 33 bcm, Ukraine 19 bcm and the Netherlands 18 bcm. Over the last decade, Qatar's production has grown by 1.6% per year, while the United States' production has increased by 4.2% per year with the development of unconventional gas and LNG. In Russia production has risen by 1.3% per year as well as in Norway.

Production in Europe, excluding Norway, is on the other hand down: in the Netherlands, production has declined by 13% per year over the last decade with the gradual decommissioning of the Groningen gas field. While reserves in the North Sea are dwindling, production in the United Kingdom is also declining (-3.4% per year).

••• Unconventional gas ••• The rapid expansion of so-called unconventional gas exploitation on the North American continent over the last decade has dramatically reshaped the world gas market. New drilling and hydraulic rock fracturing technologies have increased productivity and reduced production costs. The greater agility that characterizes these technologies allows producers to react quickly to market price signals. As a result, the United States has become the world's largest producer of natural gas.

World gas production (bcm/year)

(Source: BP Statistical Review 2022)

CONSUMPTION

The leading gas-consuming countries in the world in 2021 were the United States (827 bcm), Russia (475 bcm) and China (379 bcm). Europe consumed approximately 571 bcm (or 5,711 TWh) of gas that year. The three largest European consumers in 2021 were Germany (91 bcm), the United Kingdom (77 bcm) and Italy (73 bcm). With 3.6 bcm, or 36 TWh, Switzerland thus consumed 0.6% of European gas. In one decade (2011 - 2021), overall gas consumption increased by 2.2% per year. While gas consumption was stable in Europe, it increased by 11% per year in China and 2.3% in the United States. The US very low natural gas prices resulting from abundant supplies are gradually leading to the decommissioning of coal-fired power plants.

(Source: BP Statistical review 2022)

SUPPLY IN EUROPE

In 2021, 77% of Europe's natural gas supply was carried out by pipelines and 23% by LNG carriers.

European gas pipeline networks stretch from Siberia to Spain, from Azerbaijan to the gas fields in the North Sea (United Kingdom) and from Algeria to the Atlantic Ocean off the coast of Norway.

In 2021, Europe imported by pipeline 167 bcm from Russia, 113 bcm from Norway, 34 bcm from Algeria and 20 bcm from Azerbaijan. The balance came from Iran and Libya.

••• Nord Stream ••• The construction of the Nord Stream 1 pipeline began in 2005. It was commissioned in 2012. It is 1,222 km long and connects Vyborg in northern Russia to Greifswald in Germany under the Baltic Sea. The Nord Stream 2 project, a twin pipeline system designed to double the capacity of the existing Nord Stream 1 link, started in 2018. The pipeline has been operational since 2021, but the licensing procedure for its operation has been blocked by Germany. View more.

••• Trans Adriatic Pipeline (TAP) ••• Connected to the Trans-Anatolian Natural Gas Pipeline at the Greek-Turkish border, the TAP crosses northern Greece, Albania and the Adriatic Sea before reaching Italy. It is 878 km long and was commissioned in November 2020. View more.

Imports of liquefied natural gas (LNG) reached 108 bcm in 2021, a rise of 92% over 2016. This leap was catalyzed by the outstanding expansion of liquefaction plants in Qatar, the United States and the Yamal Peninsula on the Arctic Ocean in Russia. Thus 31 bcm of the LNG imported by Europe originated from the United States, 23 bcm from Qatar, 17 bcm from Russia, 15 bcm from Algeria and 13 bcm from Nigeria. The balance came from Trinidad & Tobago, Norway, Egypt, Angola and Peru.

••• EastMed ••• The Eastern Mediterranean (EastMed) natural gas pipeline project is expected to be one of the longest in the world (1,900 km), connecting the eastern Mediterranean to southern Europe. The pipeline is expected to bring newly discovered gas off the Cypriot and Israeli coasts to Europe, thus diversifying the supply sources. Cyprus, Greece and Israel signed an interstate agreement in 2020 and the pipeline is expected to be commissioned in 2027. View more.

European regasification terminals are located in Belgium, France, Greece, Italy, the United Kingdom, Spain and the Netherlands.

••• LNG Terminal Wilhelmshaven (LTeW) ••• Germany is planning to build a Floating Storage and Regasification Unit (FSRU) in Wilhelmshaven. This technology has the advantage of being less expensive and easier and quicker to implement than a land-based terminal. The project was abandoned due to lack of interest from investors. It was recently reactivated following Germany's desire to free itself from Russian imports. View more.

With the war in Ukraine and the gradual decrease in Russian deliveries to Europe during the spring and summer 2022, the share of Russian gas in the European mix has fallen and imports of LNG, particularly from the US, have risen sharply again.

(Source: BP Statistical review 2022)

SUPPLY IN SWITZERLAND

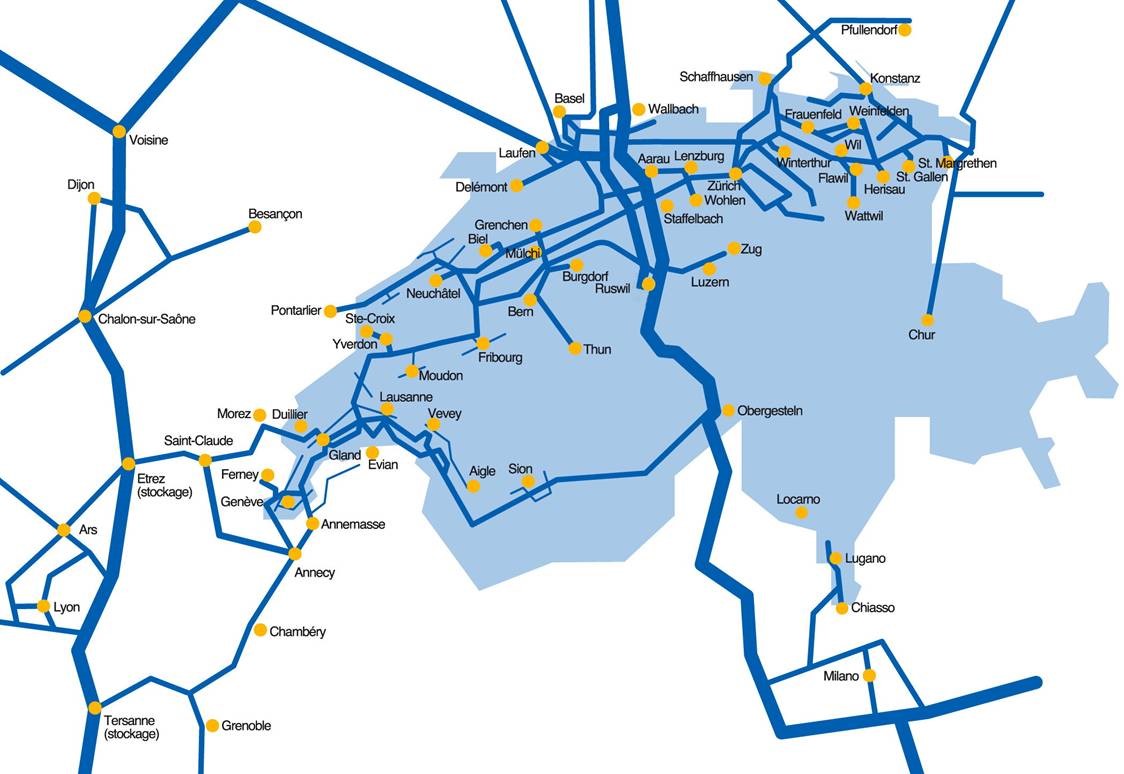

Switzerland's supply is ensured by a good connection to the major gas transmission lines in Europe.

The main entry point for natural gas into Switzerland is at the German border at Wallbach (east of Basel). The TENP (Trans Europa Naturgas Pipeline) is interconnected with the Transitgas pipeline to supply mainly northern Italy with gas from Russia and the North Sea. The pipeline crosses the Italian border at the Griess Pass. 10% of Transitgas' North-South flows remain in Switzerland for domestic supply. The Transitgas pipeline also transports natural gas from France. The entry point is located at Oltingen (west of Basel).

The other entry points of the Swiss networks are: Bardonnex/ La Louvière (in Geneva), La Cure (near Saint-Cergue in the Jura vaudois), Schönenbuch (in Basel), Fallentor (in Schaffhausen). The Ticino region is not connected to the Swiss networks and is supplied from Italy.

Learn more about Gaznat supply to western Switzerland.